Access your account and open the cashier

Use the Basswin site or app, log in to your account, then go to the cashier or balance section to start the withdrawal request.

Basswin in the United Kingdom lets you withdraw money safely using bank cards and digital currencies once the account is verified. The minimum withdrawal amount is typically £20, and the maximum withdrawal amount per transaction can reach up to £4,000, subject to your chosen payment method and account status. You can cash out to Visa, Mastercard, and several popular crypto options, sending funds from the gaming balance to your own financial account. New players can claim a 100% bonus plus 100 free spins on MergeUp from a €20 first deposit, 150% plus 125 free spins on Gemhalla from €50, or 200% plus 150 free spins on WildCashX9990 starting from €150, subject to bonus terms.

Players in the United Kingdom can withdraw funds using card payments and selected crypto options once the account and identity pass the verification process. No commission is charged by this casino on withdrawal requests, and typical Basswin minimum withdrawal levels start from £20, while the daily upper limit is around £4,000. Standard Basswin withdrawal time ranges from instant to 3 business days, depending on the payment method and checks.

| Payment Method | Min Withdrawal | Max Withdrawal | Withdrawal Time | Fees |

|---|---|---|---|---|

| Visa Credit/Debit | £20 | £4,000/day | 1‑3 business days | £0 |

| Mastercard Credit/Debit | £20 | £4,000/day | 1‑3 business days | £0 |

| Bank Transfer | £50 | £10,000/day | 1‑5 business days | £0 |

| Skrill | £20 | £4,000/day | Up to 24 hours | £0 |

| Neteller | £20 | £4,000/day | Up to 24 hours | £0 |

| PayPal (where available) | £20 | £4,000/day | Up to 24 hours | £0 |

| Trustly / Open Banking | £20 | £5,000/day | Within a few hours | £0 |

| Bitcoin | £40 | £5,000/day | Within an hour after approval | £0 |

| Ethereum | £40 | £5,000/day | Within an hour after approval | £0 |

| Litecoin | £30 | £4,000/day | Within an hour after approval | £0 |

Times and limits can vary by account status, currency and additional security checks.

You need a verified account, a positive balance, and no active withdrawal restrictions from bonuses or responsible gambling tools. Before any Basswin withdrawal request is approved, the platform may ask for extra documents to complete the identity and payment verification process.

Use the Basswin site or app, log in to your account, then go to the cashier or balance section to start the withdrawal request.

Pick the withdrawal tab, select your preferred payment method such as Visa, Mastercard, bank transfer, e-wallet or crypto, and make sure it matches a method previously used for deposits where possible.

Type the withdrawal amount in pounds sterling, check it is within the minimum and maximum limits, and confirm the destination account or wallet details.

Upload identity and address documents, or proof of bank or e-wallet ownership if the system prompts you, so that financial transactions stay safe and compliant.

Submit the withdrawal request and monitor the status in the transaction history; once approved, the funds will reach your bank card, account, or wallet according to the payment method processing time.

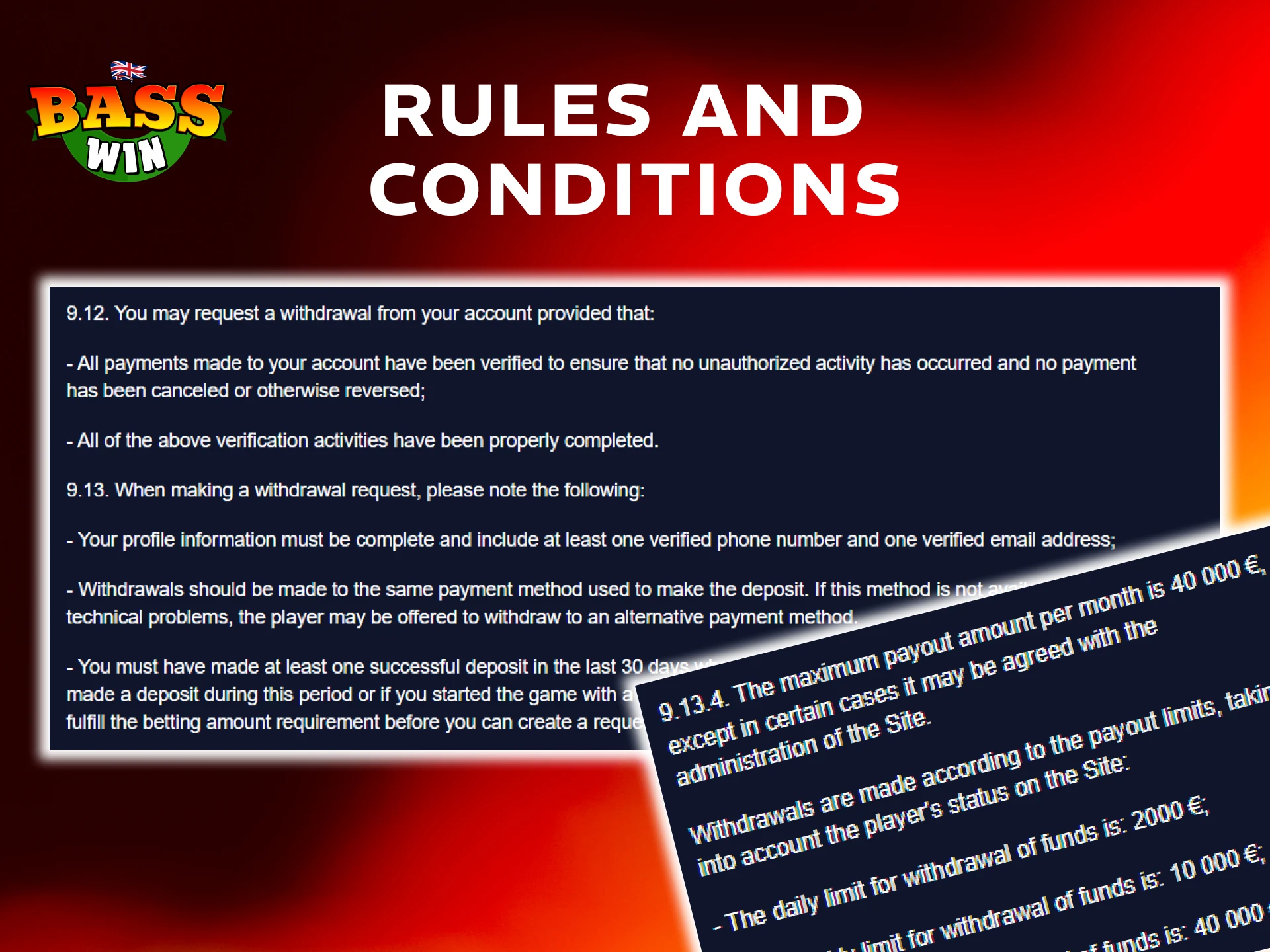

Basswin United Kingdom withdrawal rules focus on account security, local regulations, and fair play controls. Before you withdraw funds, read the main conditions that apply to any cash out request from the casino and sportsbook balance.

Here are common problems that can affect Basswin withdrawal time in the United Kingdom, along with practical steps to fix each situation.

If any problem arises during a Basswin withdrawal, dedicated support is available to help you get the payment method, account and documents in order.

Most withdrawal requests are reviewed within 24 hours once the account is verified. Card and bank payments can then take 1 to 3 business days, while e-wallets and crypto are often much quicker once approved.

The usual minimum withdrawal amount is £20 for most cards and e-wallets used on the platform. Bank transfers and some crypto options can have higher minimums, such as £40 or £50 per transaction.

Cancellation is sometimes possible while the status shows as pending in the cashier. Once the withdrawal is processed by the payment team, it can no longer be cancelled and you must wait for the funds to reach your bank or wallet.

The payment provider may have rejected the transaction, or internal checks may have failed due to inaccurate details or unmet conditions. In such cases, the money often returns to your playable balance and support can explain what to change for your next request.

No, once the verification process is complete and documents are approved, repeated checks are not usually needed. Extra checks can still occur for security reasons, such as large withdrawals or changes in payment method.

Only payment methods in your own name should be used for financial transactions on the platform. Third-party accounts, cards or wallets are usually blocked to prevent fraud and money laundering.

If you move out of the United Kingdom or change the main currency on your account, new limits and rules may apply. Contact customer support to review your account and agree on the correct currency, documents, and payment options before making a new withdrawal request.

Updated: